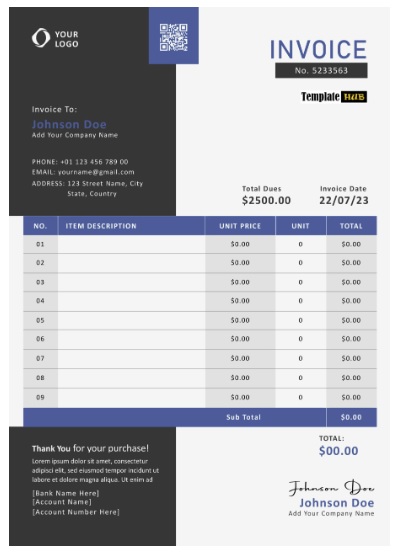

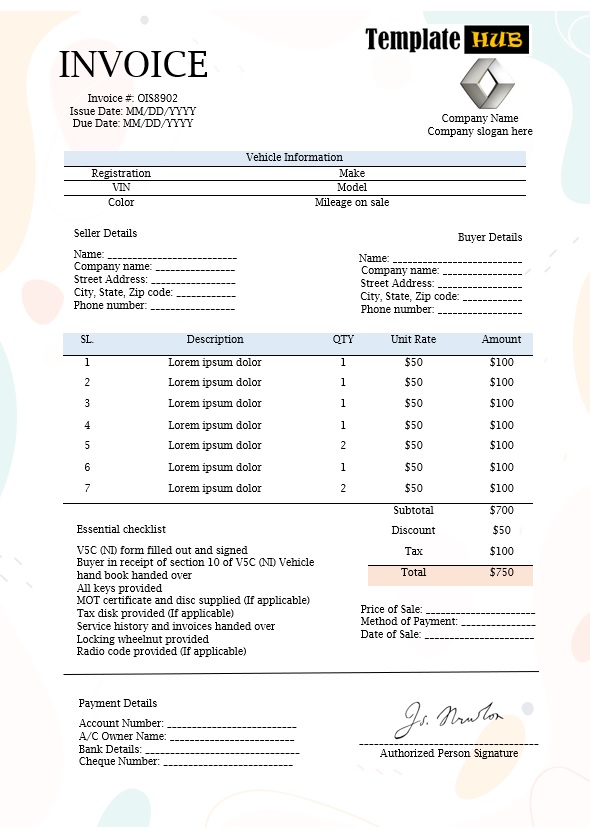

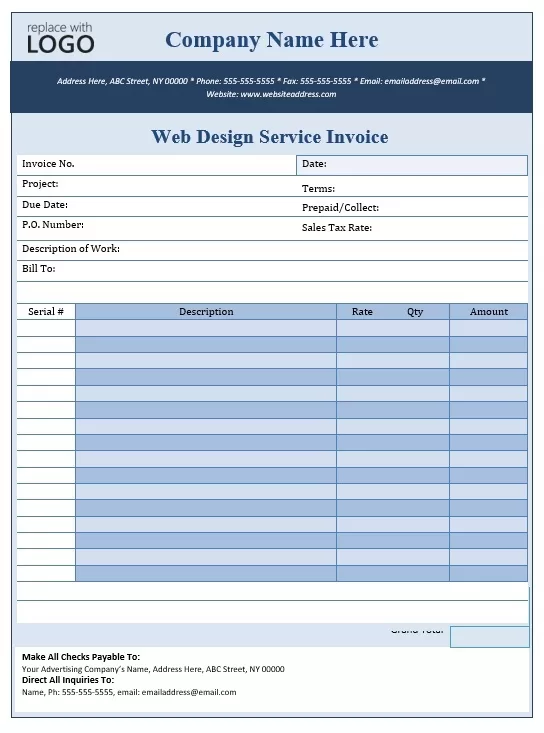

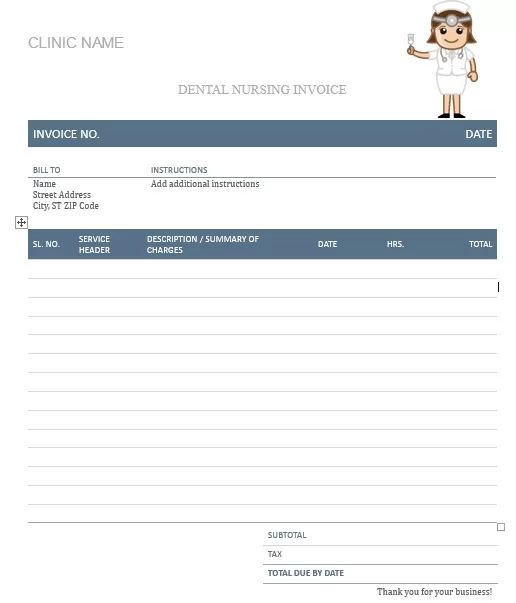

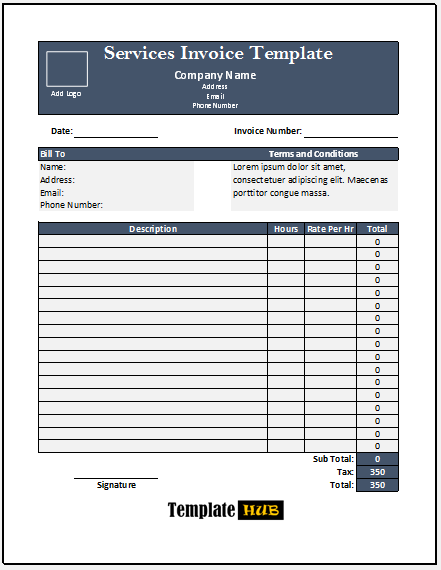

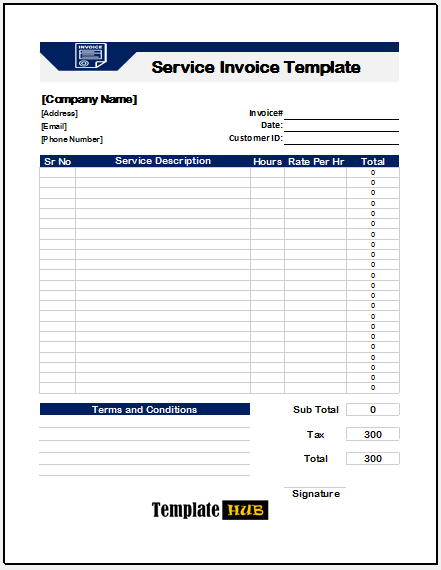

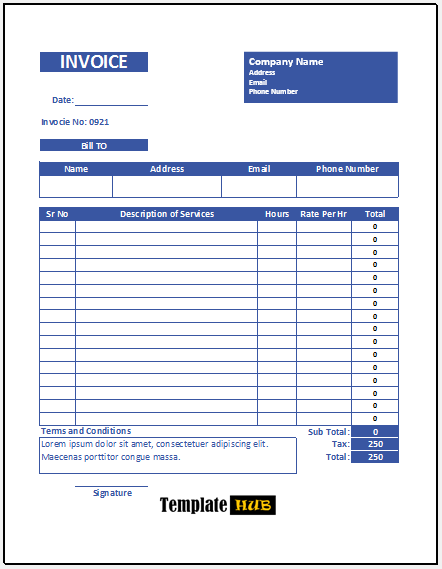

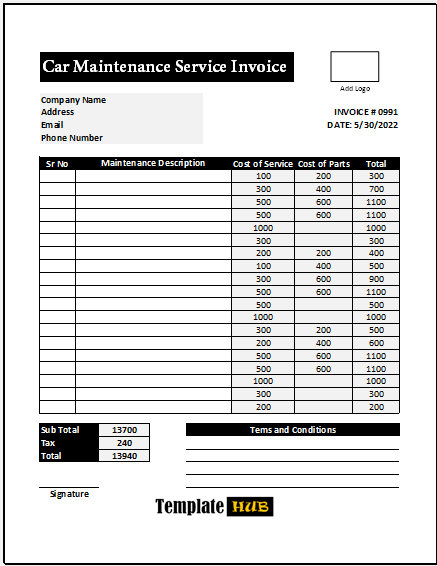

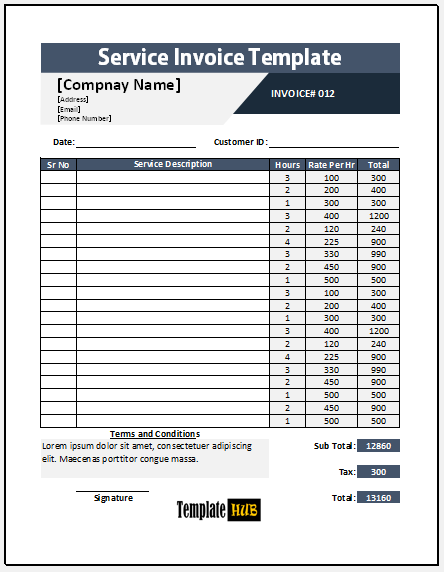

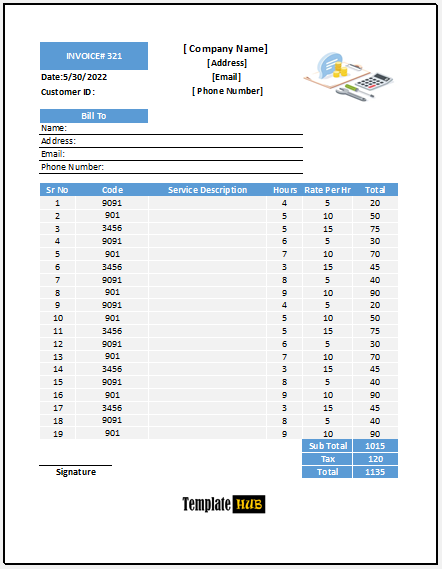

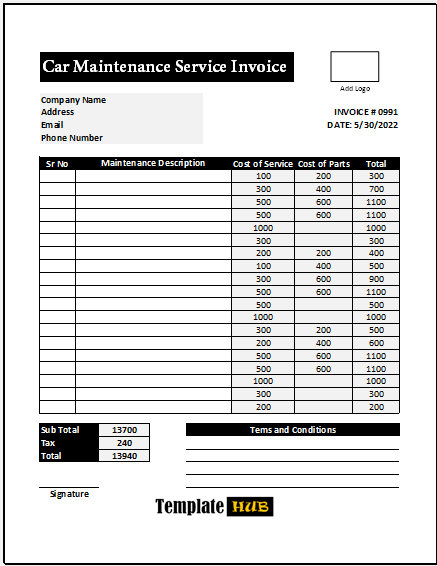

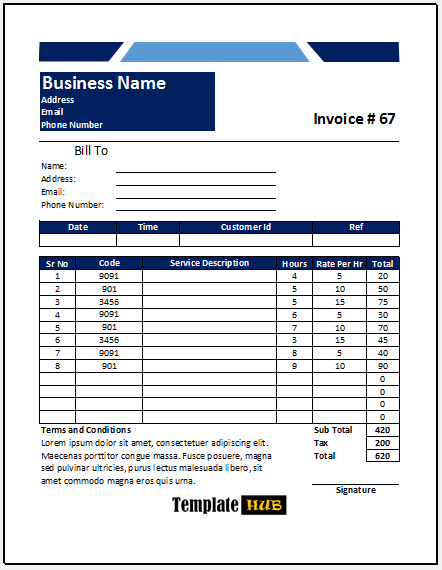

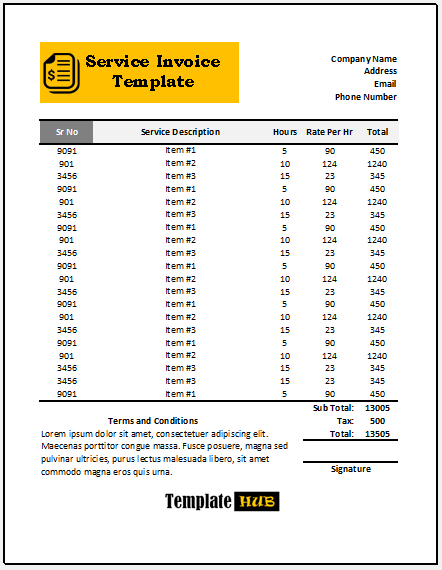

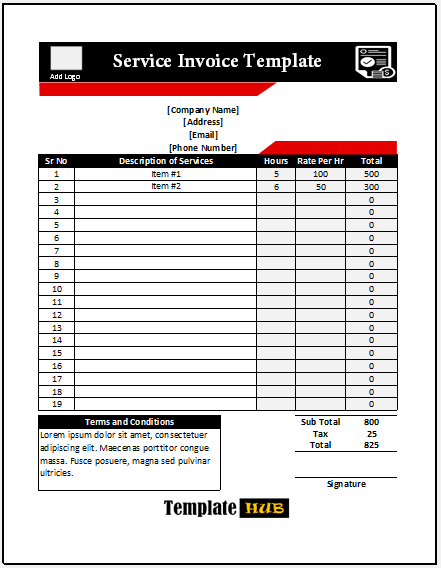

Download these 10 different Services Invoice Templates for Free and with no limitations. Anyone can use these invoice templates to design and print his/her Professional Invoice quickly.

When one sells goods to another, it is necessary to prepare the services invoice, being prepared by the seller. Specifically, it comprises data about seller’s and buyer’s names and addresses, sale dates, and the description of goods with quantities and prices. However, this document is unlike a receipt or voucher. A Voucher is evidence of a transaction in a written form showing that a particular transaction took place; this can be in the form of a cash receipt, an invoice, or cash memo, or a bank paying slip; those people carrying out the audit functions need the above evidence.

Types of Invoices:

There are 10 types of invoices prescribed to be generated for different types of transactions:

Tax Invoice:

Such invoices are issued when the supplies are made between one registered person to another registered person, as well as when supplies are from one registered person to an unregistered person. Tax invoices are also issued in case of the reverse charge in which the recipient is liable to pay tax. It is also required to be issued at the time of interstate stock transfers.

Bill of Supply:

This invoice is required to be issued for the exempt supplies or it is required to be issued by the composite dealer.

Receipt Voucher:

It is issued at the time of receipt of advance payment about the supply of goods and services.

Refund Voucher:

This voucher is issued when the advance is received for the services and the goods.

Payment Voucher:

A recipient is liable to pay tax on reverse charge and is required to issue a payment voucher at the time of making a payment to the supplier.

Debit and Credit Note:

A debit note is issued when a tax invoice has been issued about a good or service and the tax charged in that invoice is less than the taxable value of the supply and a credit note is supplied when a tax invoice has been issued for a good or service and the tax invoice exceeds the tax payable value of the supply, or when the goods supplied are returned by the recipient, or maybe when goods and services or both are found to be deficient.

ISD Invoice:

This is an ‘input service distributor’ invoice. It is issued to distribute the credit among entities having the same PAN.

Delivery Challan:

Such invoices are issued at the time of delivering goods without any issue of tax invoice.

Invoice Format:

Format of Tax Invoice:

Tax invoices should have the following particulars:

- The invoice must have the name and address of the supplier, bill number, bill date, unique ID number, etc.

- It should contain whether the tax is payable on a reverse charge basis yes/ no.

- It should also contain the name and address and unique ID number of the recipient if registered.

- The address of the recipient is mandatory if the invoice is more than 50,000 when the supplies are made to an unregistered dealer.

- It should also have the name and address of delivery along with the name of the state and its code if the place of supply is different from the place of billing.

- The invoice should have a description of the goods and services supplied. Code of the goods and services, quantity, unit, rate per item in case of goods, the total value of supplied goods and services, discount value if any, taxable value, or tax charged in respect of taxable goods and services.

- The invoice should contain the signature or the digital signature of the supplier or his authorized signature.

- The supplier may at his option mention the details of the transportation of the goods like the name of the transporter, the vehicle number, and the mode of dispatch as by air, sea, or land.

Format of Export Invoice:

Export invoices have all the particulars similar to tax invoices, except they must contain an endorsement at the top of the invoice. So, if the supplier has executed a bond and is making export of goods and services without the payment of tax then the supplier will write an endorsement as ‘supply meant for export under bond without the payment of IGST and it should not charge any tax on the invoice’.

Format of Bill of Supply:

It should have an additional column on the tax. It should contain only the taxable value and column for tax rate or amount since it is issued for making exempt supplies on which no tax is applicable.

Format of Receipt Voucher:

Also have some particulars to be mentioned such as name, address, ID number, etc. In addition, here the user has to mention the amount in advance received by the customer and the rate of tax.

Format of Refund Voucher:

In this invoice, the supplier needs to mention the receipt voucher number and the receipt voucher date for which he is refunding the amount. Rest all other things remain the same.

Format of Payment Voucher:

It can be prepared in the same manner as the refund voucher, in which all the particulars remain the same.

Format of Debit and Credit Note:

In this, the user has to mention the details of the original invoice number and the original invoice date against which the debit and credit notes have been issued. However, all other things are the same as that of the tax invoice.

Format of Delivery Challan:

The format of the delivery challah is the same as that of a tax invoice. It is issued for making any intrastate stock transfers and is required when any goods are sent for approval purposes. So, the dealer needs to mention the details of the consigned as well as the consignee.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.