In a way, you can say that depreciation is demonetizing something you buy for your business or company. Being a company owner, you understand that you need to pay taxes and that there are regular purchases in the workplace. For instance, if you manufacture, you need to buy raw materials and along with that, you also buy equipment for work purposes i.e. computers, printers, photocopiers, and production machinery. For each purchase, you also need to pay taxes and here depreciation plays an important role. Depreciation means a decrease in the value of equipment i.e. rotary machine for fabric printing and this decrease in the value occurs with time which means if you bought the same machine for $50,000, after 1 year it will be $45,000 and after five years, it will be worth $25,000. This way with the decrease in the value, you can declare it in the taxes and because it’s decreasing, you will need to pay less and less taxes each year.

Importance of Depreciation Schedule:

As explained above depreciation is a process of calculating a decrease in the value of something for tax reduction purposes. Companies and organizations don’t do the deduction in the value instantly but they schedule a particular percentage each year and get tax leverage. For instance, for an office photocopier, you will need to pay 5% less tax each year after its purchase as it will lose some of its value each year. This calculation of reduction in the cost is done with a depreciation schedule. Other than getting tax benefits, companies also use a depreciation schedule to calculate and estimate the useful life of a fixed asset along with its expiration and purchase of the replacement. Inviting a new partner into the business or letting a partner go is a common practice in organizations and a depreciation schedule helps all the partners understand the current worth of the business after calculation of depreciation on all fixed assets.

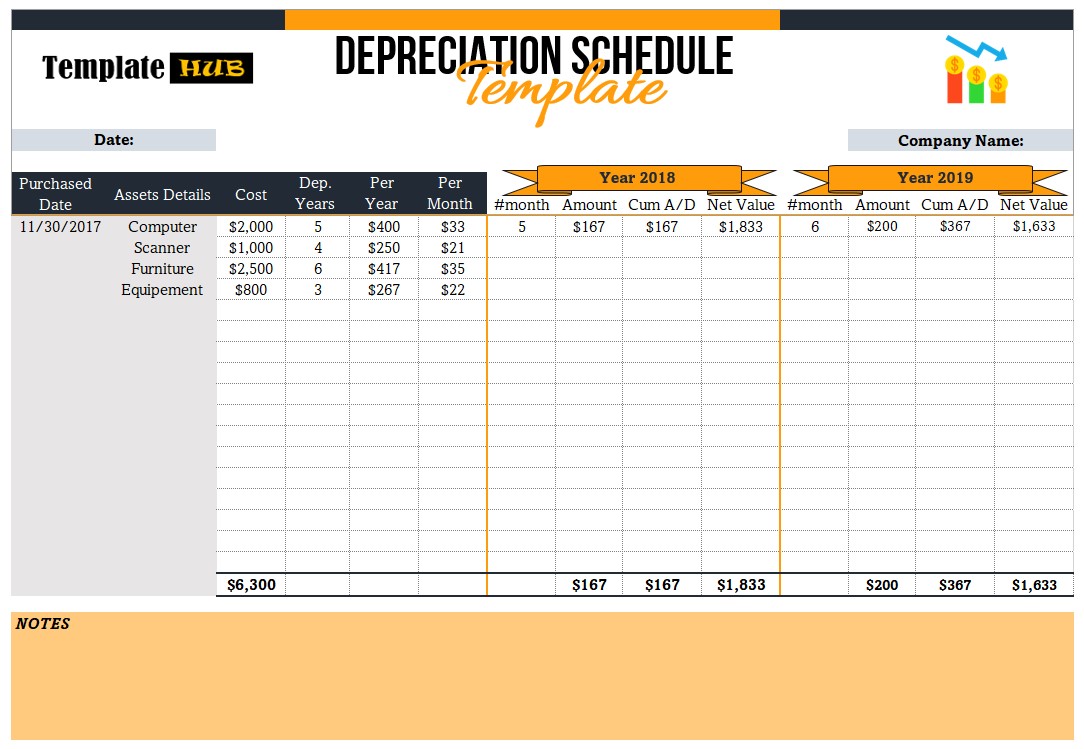

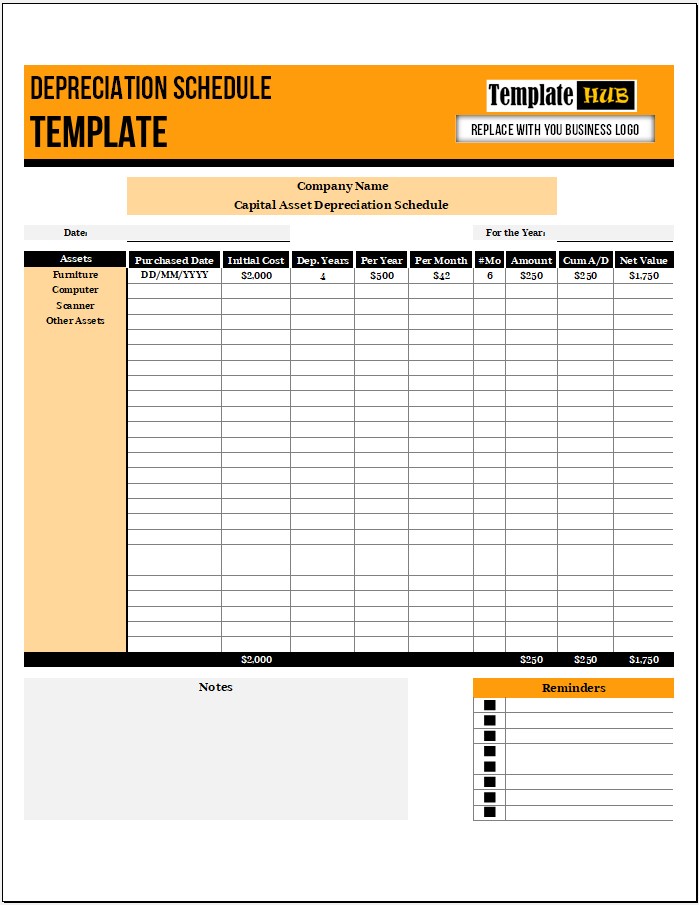

Free Depreciation Schedule Templates

Here are several free Depreciation Schedule Templates to assist you in the process of creating and printing Depreciation Schedules easily.

How Does Depreciation Schedule Work?

This schedule typically includes the description of the asset, date of purchase, price of the equipment, the useful life of the equipment, and the estimated value of the asset when it will be replaced after expiration. Because the depreciation of an asset can be different for each year, this schedule also assists the finance department in calculating the exact depreciation for the current year, total depreciation until the current date, and the estimated value of an asset to the current date. While preparing a depreciation schedule, there are 3 methods to follow; straight line method, units of production method, and declining balance method. The first method; the straight line depreciation method is useful when the value of equipment decreases in a specific pattern to prepare this schedule, you need to calculate the salvage value, deduct it from the purchase cost of the equipment, calculate useful years, and divide the cost over these years.

For the second method; units of production, you again need to calculate its net value by subtracting salvage value from purchase cost and then calculate how many units the machine will produce each year. You also need to calculate how many units the machine can produce for its entire life span and this method is useful when the use of a machine is not steady. The third method of creating a depreciation schedule is best suited for the assets that lose most of their value in the early years and the decrease of the value slows down as it gets closer to the expiration date.

Importance of Depreciation Schedules:

Although the uses of a depreciation schedule can vary from company to company as each business uses this schedule for its purposes, there are still some common scenarios to apply this schedule. Below are common situations when it’s important to create a depreciation schedule.

For Tax Deduction:

The most important and common scenario for using a depreciation schedule is when paying your taxes. Because there is a specific decrease in the net worth of each fixed asset over each year, you will need to pay less tax for the same asset over each coming year in the future until the equipment is no longer useful for business.

For Calculating the net Worth of a Business:

Companies use depreciation schedules to calculate the exact worth of a business at any given moment. Because these schedules are prepared for each fixed asset in any organization, by taking a quick look at the schedule, an accountant can instantly tell how much it is worth at any given time. This plays an important role when it’s time to sell the business or change the partnership.

For Sale and Purchase of Equipment:

Sometimes when a company doesn’t make enough money, selling the extra equipment or machinery that is not useful is a great way to bring in some money. With the depreciation schedule, you can quickly see how much each of the assets is worth currently and how much you can get by selling it. In the same sense, you can also look at the depreciation schedule of equipment before buying it to estimate its cost and remaining useful life.

For Budget Purposes:

Companies and organizations understand that depreciation means there is a specific period for which some equipment is useful and after its expiration, it will need to be replaced. The finance department can see the depreciation schedule and guide the purchasing department about which equipment will expire in the current year so they can add the price of its replacement to the current year’s budget.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.