A debit voucher is a record of payments made in cash and by cheque. Basically, it is the proof for all transactions where money is being paid out. These vouchers are commonly used for expenses such as rent, salaries, utility bills, and payments to suppliers.

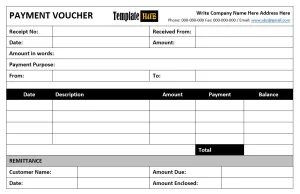

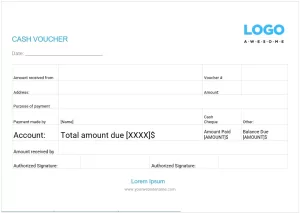

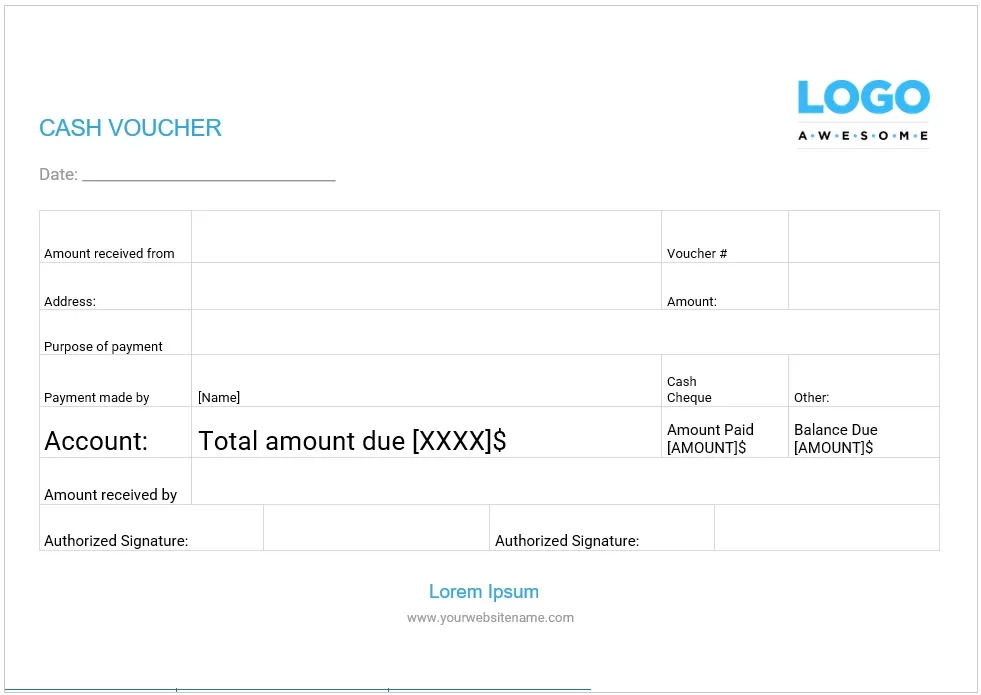

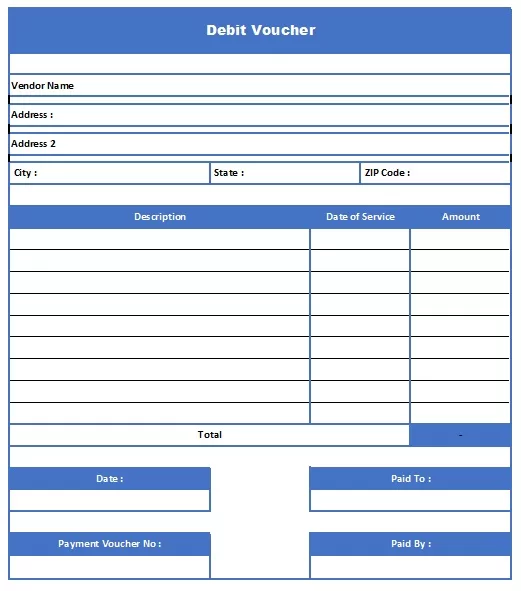

Because the voucher serves as a record for financial transactions, it has important details such as the date, voucher number, the amount paid, the name of the party receiving payment, the purpose of payment, and signatures of authorized individuals. Businesses depend upon debit vouchers for tracking their outgoing payments and for financial documentation.

Debit vouchers are utilized by organizations to enhance operational cash and bank transaction transparency. They are a necessity for bookkeeping since they furnish evidence for expenses incurred. These vouchers also provide verification during audits by examining accounting record entries.

In fact, the debit voucher is very important for any company as financial documentation. It helps maintain true records, aid audit procedures, control expenditures, and enhance overall financial management. Debit vouchers could be used for supplier payments, employee reimbursement, or day-to-day operations; in each case, they create a transparent paper trail with accountability for all financial transactions. For the greater good of their financial organization and compliance, the use of debit vouchers should be promoted and made widespread by any given business.

Free Debit Voucher Templates:

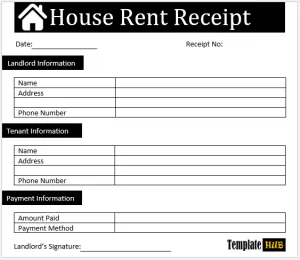

The available debit voucher templates come in MS Word, Excel, and PDF formats for ease of use. A lot of companies prefer printable or digital copies for better financial management. The use of debit vouchers ensures that transaction entries are accurate and accountable in the business.

Here are previews and download links for these Debit Voucher Templates,

Importance and Uses of Debit Vouchers

A debit voucher is an important document in accounting because it serves to confirm cash and bank payments in a company. A debit voucher is a document that embodies the transaction and the system of recording in which money is paid out; hence, it is imperative for its safety in the maintenance of accurate records. Debit vouchers are vital when it comes to the keeping of accounts, audits, and financial management since every single expense incurred by the business needs to find its labor in documentation and bookkeeping.

One of the significant functions of a debit voucher is to create transparency in the financial realm. A debit voucher is created whenever a business pays its expenses, such as rent or salaries, raw materials, or any other means of operation. This somehow serves as evidence to ensure that there are no discrepancies as far as the payments are concerned and that they are going to the right person. It gives us a systematic arrangement for tracking expenses, thereby minimizing the possibility of errors and fraudulent acts during financial dealings.

Financial auditing constitutes another major advantage of using debit vouchers. Auditors make use of these very vouchers to ascertain company expenditure levels and confirm the recorded transactions. If the debit vouchers are maintained properly, audits become easier, as they document all cash and bank outflows. Without these vouchers, a business may find it difficult to defend its expenses against compliance issues or financial mismanagement.

Debit Vouchers for Businesses

In business, debit vouchers also help control expenditures and enhance budgeting. With a thorough record of all payments made, management can analyze spending habits and make decisions about the overall financial health of the organization. The documentation of unnecessary expenditures permits adjustment into budgets, thus allowing for an efficient allocation of resources. Moreover, a systematic approach to debit vouchers permits the tracking of outstanding payments and effective cash flow management.

Debit vouchers are used for various financial transactions in small and large organizations. For example, when a company makes a payment to a supplier, it prepares a debit voucher giving particulars of the amount paid, the purpose of payment, the name of the payee, and signatures for authorization. Such practice ensures proper documentation for payments and that both parties retain a reference of the transaction.

Besides the payments done against business expenses, debit vouchers can also be used for employee reimbursement. When employees make the payment for work-related expenses such as travel and office supplies, they will submit receipts together with a debit voucher to claim reimbursement. This ensures that the company has a clear record of how much was paid back and for what reasons, which reduces the chances of a successful unauthorized claim.

While traditionally they were secretive in the modern era, businesses are actually opting for these digital debit vouchers for the sake of maintaining a leaner financial processing system. Digital, meaning options like MS Word, Excel, or PDF templates, allow a structured system for business records that are also easy to search. Along with these templates aiding in efficiency by minimizing paperwork, retrieving previous transactions becomes easy whenever it’s called for.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.