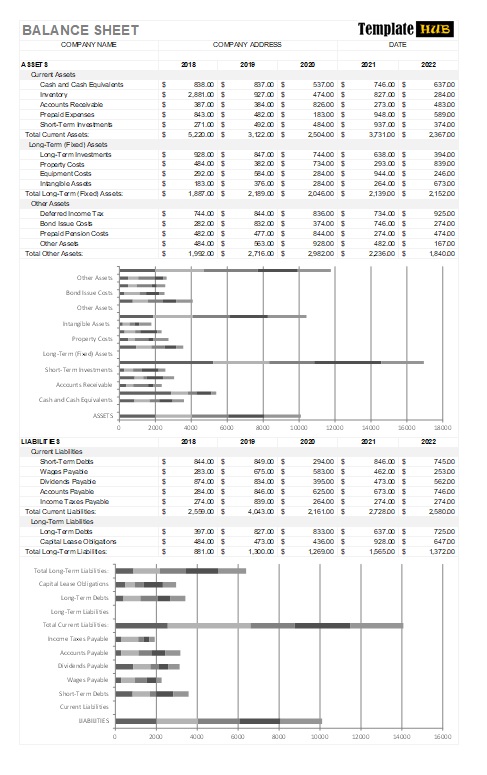

Download these 10 Free Balance Sheet Templates in MS Excel format to help you prepare your Balance Sheet.

A Balance Sheet Template is a financial document that provides a specific clear scope of a company’s financial position at a certain point in time. It corresponds between the different assets, liabilities, and equity built to help businesses track their financial condition and make the best decisions. Templates aid in minimizing financial reporting by putting important figures together into standard format; it entails accuracy and consistency. Balanced sheet templates are used for all forms of firms, be they small, medium, or multinational, for analyzing liquidity, profitability, and stability as a whole. A balance sheet lists what a company possesses: cash, accounts receivable, inventory, and the loans and expenses it owes. That means stakeholders have a clear understanding of the financial risks and opportunities that exist. Equity-representing the owner’s interest in the business is also included to complete the picture of financial standing. A well-structured balance sheet template thereby facilitates transparency in financial planning and could help achieve compliance with accounting standards, making it one of the most important tools for financial management and decision-making.

Free Balance Sheet Templates

Here are free Balance Sheet Templates in MS Excel format to help you prepare your Balance Sheet quickly.

Guidelines to Create Balance Sheet for Small Business:

The first action to take when preparing a balance sheet has to do with defining the reporting period. It represents the financial position of a business at a singular time. Most businesses prepare their balance sheets quarterly or yearly. However, it may also be formulated monthly for internal purposes. By having the date clearly pasted on the document, it will not be hard for anyone using that balance sheet to analyze and compare data from various periods.

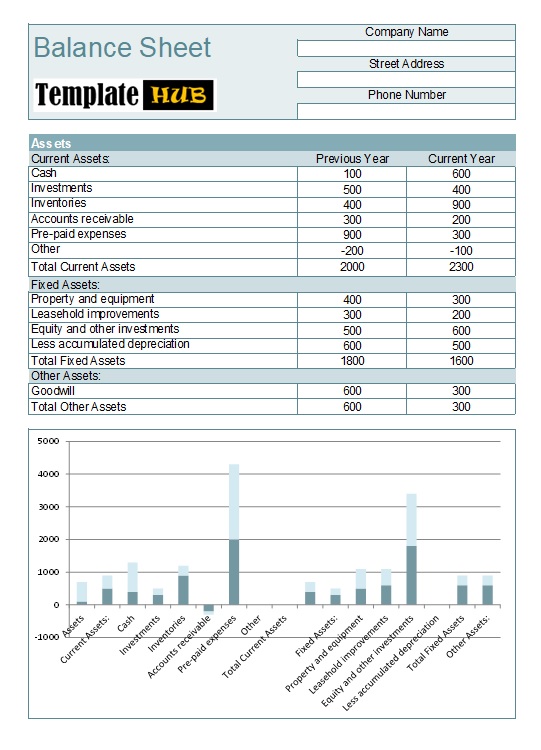

List All Assets Accurately

Assets can be classified as current and non-current according to their liquidity and long-term worth. Current assets comprise cash, accounts receivable, and inventories that can be converted into cash in less than a year. Non-current assets reflect long-term value; they include property, equipment, and investments, thus affecting the overall financial soundness of the business. When all assets are stated accurately, they portray a true reflection of the available resources.

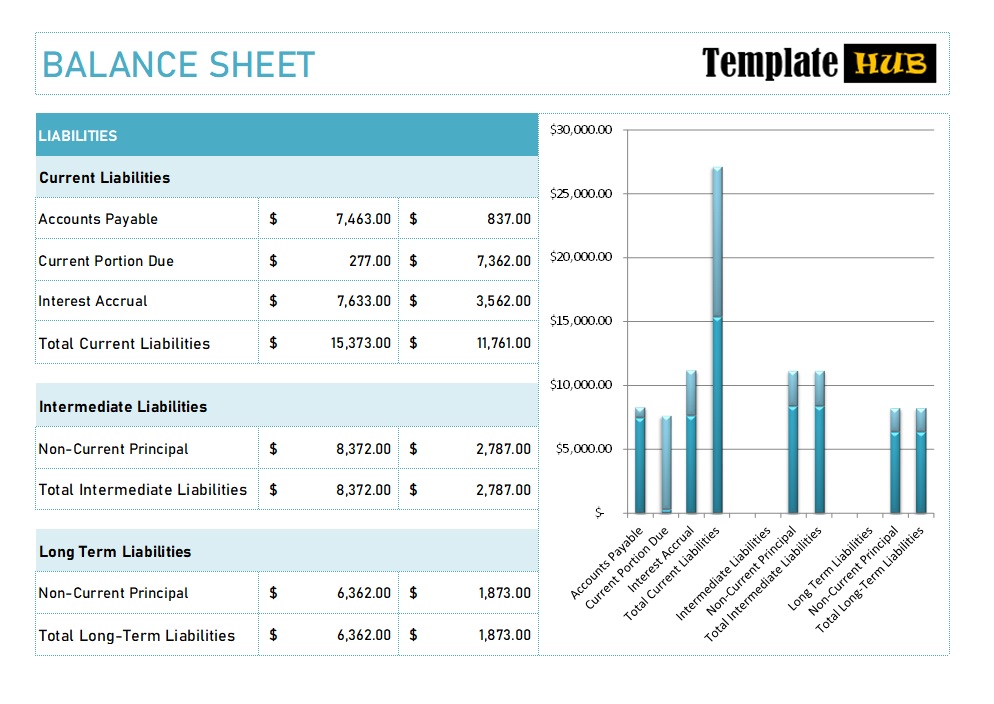

Identify and Organize Liabilities

Liabilities are also further classified into current and non-current. Current liabilities include those short-term debts such as accounts payable, wages, and taxes that are due within a year. All non-current liabilities refer to debts that are long term and due beyond a year, like loans and bonds. Thus, classification of liabilities gives an assessment of the financial obligation and cash flow requirements.

Calculate and Present Equity

It is that portion of a business that represents its owner’s funds in that business, comprising both retained earnings and invested capital. Equity is thus the difference between an organization’s total assets and its total liabilities. A well-constructed equity section should demonstrate the business’s financial health and ability to continue operations.

Maintain Accuracy and Clarity

A balance sheet must always maintain the equation: Assets = Liabilities + Equity to ensure financial accuracy. Clear formatting, proper organization, and regular updates enhance its reliability and usability for decision-making and financial planning.

Long-Term Assets:

A long-term asset, also known as non-current, is one which a company possesses and expects to make use of for a long time, probably beyond a year. Their importance is mostly to the operations of the business and the long-term financial security of the organization. Besides that, the current assets are rather easy to convert to cash, but long-term assets cannot be easily sold or consumed in organizations that aim at revenue generation and also with regard to the operational efficiency of making them available.

Types and Importance of Long-Term Assets

Long-term assets are classified as either tangible or intangible. The tangible ones consist of these physical items including the land and buildings as well as equipment, vehicles, and machinery. They typically only incur depreciation with time and provide long-run value. This is unlike intangible assets, which include intellectual property, patents, trademarks, goodwill, and brand recognition. As these assets do not have tangible forms, their very worth is significant and serves as a source of financial potentiality for a company in competition.

Accounting and Depreciation Considerations

Long-term assets must be accounted for properly to represent their true value over time, as tangible assets mostly depreciate due to wear and tear. Businesses record that depreciation as an expense to account for asset usage. An intangible asset may be subject to a process similar to depreciation. Amortization involves spreading the acquisition of the intangible asset across its useful life. Knowledge of depreciation and amortization of long-term assets assists businesses in assessing their financial position accurately and planning for future investments. In addition, managing these assets will provide long-term growth and stability, as well as sound financial performance over the long haul.

Short-Term Liabilities:

Short-term liabilities or current liabilities are obligations to pay within one year that can come about from daily operations and have the great importance of being an assessment of an organization as it relates to short-term financial health. Strong controls keep the business in liquidity status so that it can pay its financial commitments within due time. Well-maintained short-term liabilities do entitle organizations to have goods with cash flow problems and keep operations running smoothly.

Common Types and Their Impact

Such liabilities include current accounts payable for short-term loans, loans taken up for less than a year, accrued expenses, and taxes payable. Current accounts payable consist of unpaid obligations to suppliers for goods and services bought by an entity. Short-term loans are amounts borrowed that are to be repaid within a year; most businesses use them to finance immediate operational expenses. Accrued expenses represent the amount owed but not yet paid for incurred liabilities, for example, salaries, utilities, and interest. Taxes payable refer to the duties imposed by the government that need to be paid shortly. Effective management of these obligations maintains financial soundness and even ensures compliance with monetary obligations.

Role in Financial Analysis and Planning

It is paramount to watch short-term liabilities to comprehend a company’s liquidity position. This is especially expressed through quantitative instruments like the current ratio and quick ratio, which print a ratio between a company’s ability to use available assets in a timely manner to soak up the possible obligations. When there is a great deal of short-term liabilities and a small current asset pool, then an indication of financial distress surfaces. Or effective management is, again, shown in how it can ensure a strong cash position. Businesses working towards short-term liabilities will balance themselves out efficiently in being able to maintain a stable financial position, mitigate financial risks, and grow toward long-term strategies.

Long-Term Liabilities:

Non-current obligations are also known as long-term liabilities because these liabilities become effective in a time period longer than a year. Long-term liabilities often fund major business operations, including growth initiatives, infrastructure development, and so on. Large-scale investments typically include payment schedules configured over a lengthy span of time, thus differentiating these payments from those related to short-term obligations, which will have to be redeemed within a maximum possible time span of one year. While short-term obligations will require a company’s settlement of the liabilities in a year’s time, long-term obligations are structured with much longer repayment schedules, giving businesses broader strategic horizons to consider when managing their financial commitments.

Types and Significance in Business Finance

Among the most popular long-term liabilities include payable bonds, long-term loans, deferred tax liabilities, and pensions. Payable bonds represent debt securities obligating the company to repay at the end of many years with interest. Long-term loans obtained from lending institutions help businesses finance the expansion of their projects, purchase fixed assets, or improve operations. Deferred tax liabilities result from deferred recognition of income according to financial accounting rules over tax rules. The pension obligation is the commitment the company has made to provide some retirement benefits to employees and is funded over time. These sorts of liabilities are important because they form the backbone of a company’s financial structure. Capital is raised through these liabilities for long-term stability and expansion purposes.

Financial Implications and Risk Management

Properly managing long-term debt is key to maintaining a strong financial position. Companies establish debt levels that do not overburden them while using the same liabilities to grow. Important ratios like the debt-equity ratio help assess whether a company can perform the management of long-term liabilities. Smart financial planning accommodates the repayment schedule together with revenue generation and reduces risk, fostering a climate for viable business growth.

Kamran Khan is a seasoned blogger with a deep-seated passion for office document processes and the art of productivity. With a wealth of experience spanning over a decade, Kamran has become a trusted name in the blogging community, known for his insightful articles and practical solutions that help individuals and businesses streamline their daily operations.